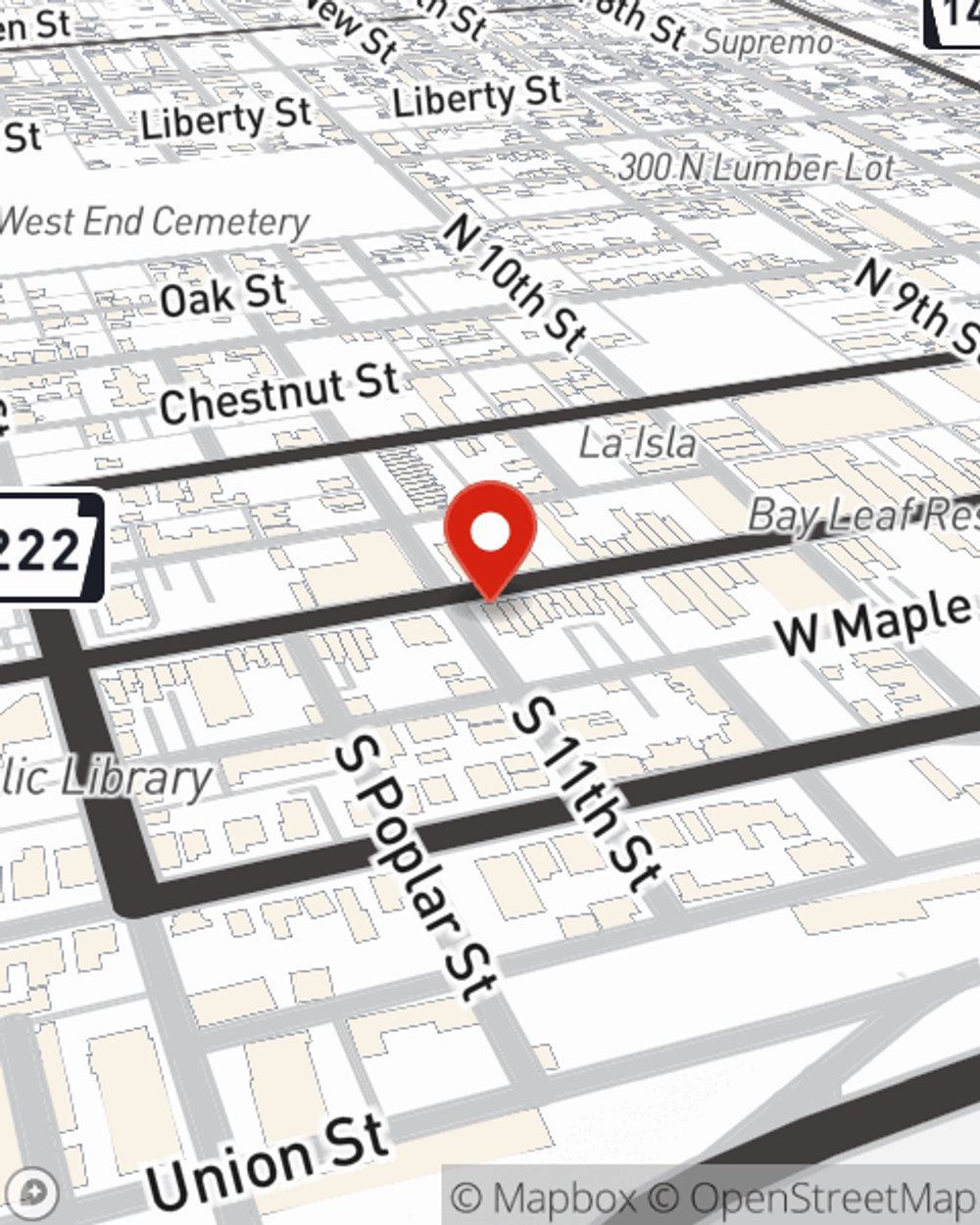

Renters Insurance in and around Allentown

Welcome, home & apartment renters of Allentown!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Home Is Where Your Heart Is

No matter what you're considering as you rent a home - internet access, utilities, location, townhome or house - getting the right insurance can be essential in the event of the unanticipated.

Welcome, home & apartment renters of Allentown!

Rent wisely with insurance from State Farm

Protect Your Home Sweet Rental Home

The unexpected happens. Unfortunately, the personal belongings in your rented condo, such as a tool set, a bed and a coffee maker, aren't immune to abrupt water damage or tornado. Your good neighbor, agent Frank Armetta, is committed to helping you examine your needs and find the right insurance options to protect your personal posessions.

Renters of Allentown, State Farm is here for all your insurance needs. Call or email agent Frank Armetta's office to learn more about choosing the right coverage options for your rented property.

Have More Questions About Renters Insurance?

Call Frank at (610) 433-5753 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Frank Armetta

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.